Keeping Financial Records Guide

Recording and summarising financial activity.

- Download PDF326.8 KB

- Download Word Doc188 KB

What are you looking for?

Hit enter to search

Recording and summarising financial activity.

Typical financial records include:

Make sure you get some form of documentation for every financial transaction realted to the business and file them carefully. Sort records by calendar month and financial year.

As well as the actual documentation, you will also need to record transactions in a series of books, kept either manually or on a computer. These usually include:

Summary information from all of the above will then help to produce your management accounts.

Management accounts should be prepared throughout the year by a suitably qualified person – either in house or freelance is fine. Monthly management accounts help senior management and boards monitor how a business is doing, and see whether any action is needed.

Many companies use accounting software like SAGE. Small companies, however, can record the same information and produce the same reports manually or with a spreadsheet package like MS Excel. Although manual entry can be the most practical and easiest to achieve, it’s best to use a computerised system as the business becomes more complex.

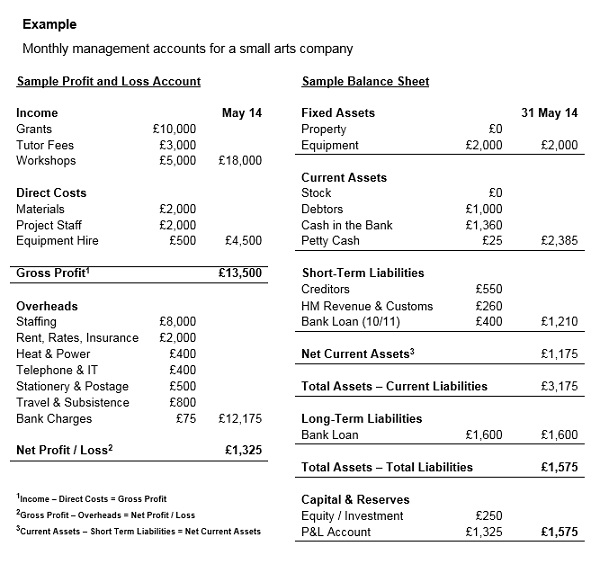

Management accounts are made up of two parts:

The P&L account shows the actual income and expenditure over a given period (e.g. monthly, quarterly or annually) and the resulting profit or loss. The information recorded in your nominal ledger is summarised in the P&L account.

The structure of your P&L account should closely follow the structure of your company budget (see Budgets Guide). That allows you to compare actual income and expenditure against your original budget – a useful analysis for you, your board and/or funders.

All individual records of income and expenditure will be summarised on the P&L account. As in your budget, that includes direct costs for work you’ve carried out, and where you’ve earned money as a result. It also covers overheads, which relate to the cost of running your business on a day-to-day basis – rent, office costs, insurance etc.

An example of a small arts company’s monthly profit and loss account is shown at the end of this guide.

There are certain conventions that mean you must include and exclude particular transactions. For example:

To create a monthly profit and loss account, add up all income and expenditure from that month and record the totals against the relevant heading. Your standard formula will be:

Total income - expenditure (direct costs and overheads) = net profit (or loss)

At the end of the year, add all months together and you have a full year’s profit and loss account.

For most people, the balance sheet is not as straightforward as the P&L account. But it can give a far more illuminating picture of how the company is doing. Rather than showing how much business the company brought in, and how much it spent, the balance sheet shows how much money it has at a particular point in time.

It also records how much the company owns (e.g. cash in the bank, property, and equipment) and how much it is due to be paid. And it shows how much money is owed to others - suppliers, lenders and HM Revenue & Customs. It takes into account any money that has been invested in the company and any profit (or loss) achieved in the year so far.

To the trained eye, a company’s balance sheet shows whether the company is – or is likely to be - in financial difficulties. That demonstrates if it is too high a risk for lenders or funders. It will show when the company has money in the bank, is good at getting paid and pays its own bills quickly. That’s an attractive prospect for investors.

The balance sheet, like the P&L account, always follows a set format and always balances. We strongly recommend you get some help with producing your first balance sheet. It may be worth getting some advice on how to structure and maintain your accounts. There’s no reason why you can’t do this in-house, as long as you take the time to set things up properly from the start. You must also allocate time once a month to update your records. If you really find it difficult to do this on your own, think about employing a bookkeeper on a part-time basis.

Anyone who is self-employed, or part of a partnership or limited company must, by law, keep accurate financial records and submit a summary of these each year to HM Revenue & Customs (HMRC). That can be in the form of either a self-assessment or a corporation tax return. Limited companies must submit statutory accounts to Companies House as well as filing their annual return.

Begin keeping accurate records of all income and expenditure as soon as you start trading. You should also record any other financial activity relating to the business. Don’t throw them away at the end of the year. You’re required to keep financial records for at least seven years.

Limited companies must set up a separate bank account in the name of the company and use it for all company transactions. The government, through agencies like HMRC, is entitled to inspect your financial records at any time. So it’s essential you take the time to maintain your records properly.

All limited companies must also produce statutory accounts each year. These are submitted to Companies House. Once submitted, they become public documents available, for a small set fee, to anyone on request. The complexity of UK tax law means companies normally use qualified accountants to prepare their statutory accounts at the end of the year.

Companies with a turnover of more than £6.5 million must have their accounts audited, (a much more in-depth analysis), by a registered auditor each year. Charities with a turnover of more than £500,000 require an audit, while those with turnover between £250,000 and £500,000 require an independent accountant’s report.

Individuals and partnerships are only required to complete a tax return each year, rather than a set of statutory accounts. Many, however, also prepare sole trader or partnership accounts to allow them to complete their tax returns, and as an effective means of monitoring and reporting trading during the year.

Remember, the balance sheet must always balance: total assets - total liabilities = total capital and reserves

Monthly management accounts for a small arts company:

You’ll find more information about financial management from our How to Manage Your Cash guide.